Pvm Accounting for Beginners

Pvm Accounting for Beginners

Blog Article

Pvm Accounting for Dummies

Table of ContentsPvm Accounting Fundamentals ExplainedThe Ultimate Guide To Pvm AccountingFascination About Pvm AccountingFacts About Pvm Accounting UncoveredHow Pvm Accounting can Save You Time, Stress, and Money.The Main Principles Of Pvm Accounting

Supervise and handle the creation and approval of all project-related billings to customers to cultivate great communication and avoid issues. Clean-up accounting. Ensure that ideal records and documents are sent to and are updated with the internal revenue service. Ensure that the accountancy procedure abides by the law. Apply needed construction bookkeeping requirements and treatments to the recording and coverage of building activity.Understand and maintain typical cost codes in the audit system. Communicate with various funding companies (i.e. Title Business, Escrow Business) pertaining to the pay application process and needs required for settlement. Manage lien waiver disbursement and collection - https://pvm-accounting-46243110.hubspotpagebuilder.com/blog/building-financial-success-with-construction-accounting. Display and fix financial institution issues including charge abnormalities and check differences. Aid with carrying out and maintaining interior economic controls and treatments.

The above statements are meant to define the basic nature and degree of job being performed by people appointed to this category. They are not to be construed as an exhaustive listing of responsibilities, responsibilities, and abilities needed. Employees might be required to carry out tasks beyond their regular obligations periodically, as needed.

The 15-Second Trick For Pvm Accounting

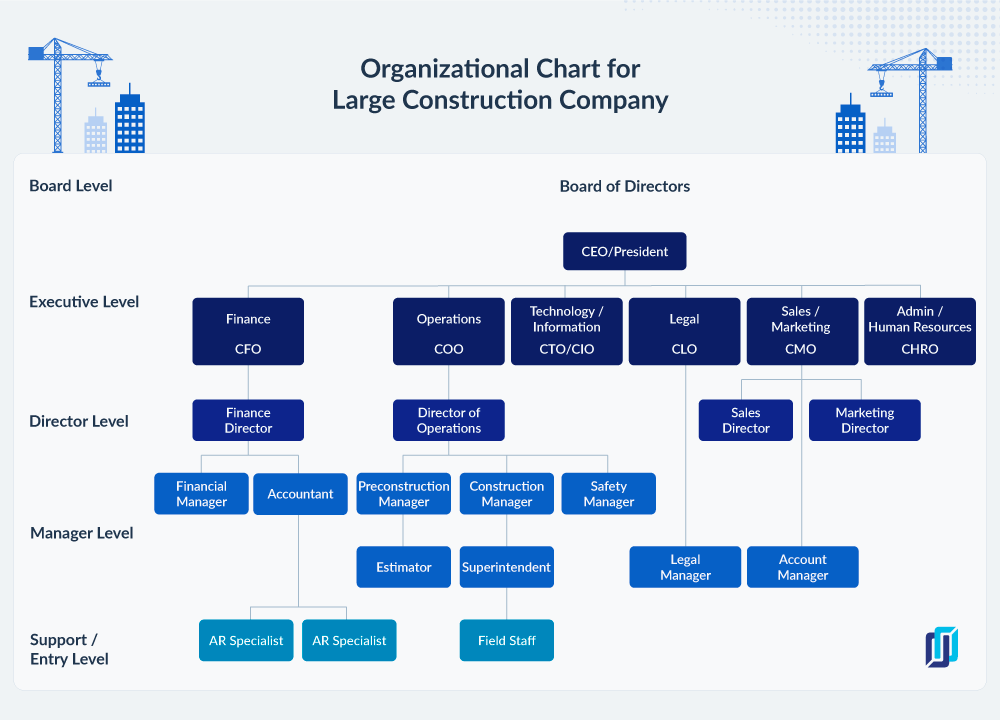

You will certainly assist support the Accel group to make sure shipment of successful on time, on spending plan, jobs. Accel is seeking a Building and construction Accounting professional for the Chicago Office. The Building and construction Accounting professional carries out a selection of accountancy, insurance policy compliance, and task administration. Works both separately and within particular divisions to preserve financial documents and make sure that all records are maintained current.

Principal responsibilities consist of, but are not restricted to, handling all accounting features of the company in a prompt and exact way and giving reports and routines to the company's certified public accountant Firm in the prep work of all economic declarations. Ensures that all accountancy treatments and functions are handled properly. In charge of all monetary documents, payroll, banking and everyday procedure of the bookkeeping function.

Works with Job Managers to prepare and publish all regular monthly invoices. Produces monthly Job Cost to Date records and functioning with PMs to integrate with Task Supervisors' spending plans for each task.

Getting The Pvm Accounting To Work

Proficiency in Sage 300 Construction and Property (previously Sage Timberline Office) and Procore construction administration software an and also. https://anotepad.com/notes/4hdynf83. Need to likewise be skilled in other computer system software application systems for the preparation of records, spread sheets and various other accountancy analysis that might be needed by management. financial reports. Need to possess solid organizational abilities and ability to focus on

They are the monetary custodians who make sure that construction jobs remain on budget plan, comply with tax laws, and preserve economic transparency. Building accounting professionals are not just number crunchers; they are calculated partners in the building process. Their main duty is to manage the monetary facets of construction jobs, making certain that resources are alloted efficiently and monetary threats are minimized.

More About Pvm Accounting

They function closely with project managers to create and keep an eye on spending plans, track expenditures, and projection economic demands. By preserving a limited grasp on task funds, accounting professionals assist stop overspending and monetary obstacles. Budgeting is a keystone of effective building and construction tasks, and construction accountants are instrumental in this regard. They create detailed budgets that incorporate all task expenditures, from products and labor to licenses and insurance coverage.

Browsing the complicated web of tax obligation guidelines in the building and construction market can be challenging. Construction accounting professionals are well-versed in these guidelines and make certain that the project abides by all tax obligation demands. This includes handling payroll tax obligations, sales taxes, and any kind of other tax obligation obligations details to building. To master the duty of a building accounting professional, individuals require a solid instructional foundation in audit and financing.

Additionally, accreditations such as Qualified Public Accountant (CERTIFIED PUBLIC ACCOUNTANT) or Qualified Construction Market Financial Expert (CCIFP) are extremely regarded in the market. Building jobs typically include tight due dates, changing policies, and unforeseen costs.

3 Easy Facts About Pvm Accounting Shown

Ans: Building and construction accounting professionals produce and keep an eye on budget plans, determining cost-saving chances and making sure that the job stays within budget plan. Ans: Yes, building accounting professionals manage tax obligation conformity for building jobs.

Introduction to Building And Construction Accountancy By Brittney Abell and original site Daniel Gray Last Updated Mar 22, 2024 Building companies need to make challenging choices amongst lots of financial choices, like bidding process on one project over an additional, picking financing for products or tools, or setting a project's earnings margin. Building is a notoriously volatile sector with a high failing rate, slow-moving time to repayment, and irregular money circulation.

Manufacturing involves duplicated procedures with conveniently recognizable prices. Manufacturing needs different processes, products, and tools with differing prices. Each job takes area in a brand-new location with varying website conditions and unique difficulties.

The Best Strategy To Use For Pvm Accounting

Regular usage of various specialty professionals and vendors influences efficiency and cash flow. Repayment shows up in complete or with normal settlements for the complete agreement quantity. Some section of settlement might be held back until project conclusion also when the contractor's work is finished.

While traditional suppliers have the advantage of controlled settings and enhanced production procedures, building companies have to regularly adapt to each brand-new project. Also somewhat repeatable tasks need modifications due to website conditions and various other factors.

Report this page